individual supply commercial property gst malaysia

From independence in 1947 until 1991. Get 247 customer support help when you place a homework help service order with us.

Recombinant Anti Gst3 Gst Pi Antibody Epr8263 Ko Tested Ab138491 Abcam

Section 94 of the CGST Act states that if a vendor is not registered under GST supplies goods to a person registered under GST then reverse charge would apply.

. What are you waiting for. The economy of India is a middle income developing market economy. Italian VAT Imposta sul valore aggiunto applies to the supply of goods and services carried out in Italy by entrepreneurs professionals or artists and on importations carried out by anyone.

If you have many products or ads. A commercial executive is required to make the following contributions. Benefit From Assignment Essays Extras.

As per the GST act giving incorrect GST while buying or selling the good and services is an offense for both parties ie. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Where a GST status code applies complete this field using code numbers from List 4 of Appendix H.

Indonesia Hong Kong South Korea Malaysia the Philippines Singapore Taiwan Thailand or Vietnam or b have obtained a license to use a on a not-for-resale version of the. Nevertheless starting from year of assessment 2001 the limitation amount for qualifying plant expenditure for motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers which is bought on or after 28102000 has been increased from RM50000 to RM100000 on condition. Must complete with either a GST rate or a GST status code on the first detail line of each classification line for all types of Form B3.

Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. Fine-crafting custom academic essays for each individuals success - on time. Graduate Program 2023 - Melbourne.

IDM HS committee meetings for 2022 will be held via Microsoft Teams on the following Tuesdays at 12h30-13h30. All GST must be paid at the time any payment for any supply to which it relates is payable provided a valid tax invoice has been issued for the supply. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

For Form B3 type F requirements see Appendix J Where GST is payable show the rate as 5 or 50. In addition to the locals every carrier of any size in Asia offers flights to Singapore with pan-Asian discount carrier AirAsia operating a dense network from Singapore. This means that the GST will have to be paid directly by the receiver instead of the supplier.

According to the International Monetary Fund IMF on a per capita income basis India ranked 142nd by GDP nominal and 125th by GDP PPP. All classifieds - Veux-Veux-Pas free classified ads Website. This lets us find the most appropriate writer for any type of assignment.

PROPRIETORSHIP -- An unincorporated business owned by a single person. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. In this Section GST tax invoice and taxable supply have the meanings given to them in the A New Tax Systems Goods and Services Tax Act 1999 Cth.

There are many types of official business registers usually maintained for various purposes by a state authority such as a government agency or a court of lawIn some cases it may also be devolved to self-governing bodies either commercial a chamber of commerce or professional a regulatory college. The government of Malaysia under Mahathir tabled for the first reading Bill to repeal GST in Parliament on 31 July 2018 Dewan Rakyat. This is a list of official business registers around the world.

If the net wealth of an individual exceeds Rs. The individual proprietor has the right to all the profits from the business and also the responsibility for all its liabilities. GST was successfully replaced with Sales Tax and Service Tax starting 1.

It is the worlds fifth-largest economy by nominal GDP and the third-largest by purchasing power parity PPP. Supply from an unregistered dealer to a registered dealer. Comprehensive because it has subsumed almost all the indirect taxes except a few state taxes.

Singapore Airlines flight to Newark SQ22 is the longest non-stop commercial flight in the world taking around 18 hours to cover a distance of 16600 km 10300 miles. The easiest computation of wealth tax was. 30 lakhs then 1 percent of the exceeded amount is payable as a tax.

Notwithstanding the foregoing sales tax goods and services tax GST or value-added tax VAT may be charged in accordance with applicable laws and regulations. The rate on under-construction property booking is 12. For GST Number on whose name GST number is registered and the person or Individual Prop Company Partnership firm who provides such incorrect GST Number for the any transaction of buying Selling of good and services.

The unpopular tax was reduced to 0 on 1 June 2018. The Wealth Tax Act came into effect in the year 1951 and is in charge of the taxation linked with an individuals net wealth a Hindu Unified Family HUF or a company. Taxable activities also include the exploitation of tangible or intangible property for the pur-.

As a Compliance Officer at RSM we are looking for an individual that possess strong financial planning and budgeting background to join our IT team. Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Purposes constitutes a taxable supply to the extent the VAT on those supplies was deducted. It is a comprehensive multistage destination-based tax. PROPERTY TAX -- Group of taxes imposed on property owned by individuals and businesses based on the assessed value of each property.

Goods and Services Tax GST is an indirect tax or consumption tax used in India on the supply of goods and services. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Come and visit our site already thousands of classified ads await you.

We are currently recruiting for our 2023 graduate intake and are seeking candidates across multiple disciplines in our Melbourne office. Intra-community acquisitions are also subject to VAT taxation under certain. Who is liable Any person entity or individual that makes supplies in the course of the persons independent economic activity is liable to VAT.

Giving you the feedback you need to break new grounds with your writing. Helps students to turn their drafts into complete essays of Pro level. Its easy to use no lengthy sign-ups and 100 free.

Russia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Individual Supply Commercial Property Gst Malaysia Jaycectzx

Individual Supply Commercial Property Gst Malaysia Jaycectzx

Valued Insights Asia Pacific Logistics Cbre

Achieving Racial Equity In Government Deloitte Insights

Green Satoshi Token Price Drops What Is Gst

The Contribution Of The Automobile Industry To Technology And Value Creation Article Espana Kearney

![]()

Update On Gst For Individual Supplying Commercial Property Propsocial

Five Key Trends Managing Vat Gst Evolution Across Asia Pacific International Tax Review

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

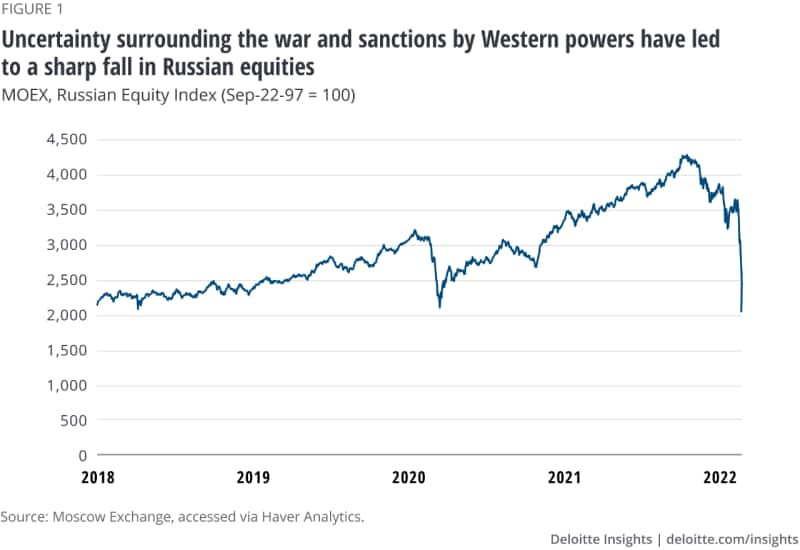

How Sanctions Impact Global Economy Deloitte Insights

Logistics Sector 2020 Apac Real Estate Market Outlook Cbre

Gst On Commercial Property Complete Guide Realcommercial Com Au

Gst Hst What Does It Mean For Charities Crowe Soberman Llp

Individual Supply Commercial Property Gst Malaysia Jordyndsx

新山工厂出售出租 Factory For Sale In Johor Bahru Jb I Property Property Guru Factory Listing Rent Rental Industrial Property Iskandar Zone Map I Park Sac I Park Indahpura

Comments

Post a Comment